Hey there, fellow crypto enthusiasts! It’s your friendly neighborhood frog, Pepe, here to chat about Centralized Exchanges (CEXs) – the backbone of the crypto world! 🐸✨

So, what exactly are CEXs? Well, they’re like the bustling marketplaces of the crypto world, where you can buy, sell, and trade your favorite digital currencies.

Just like stock exchanges, CEXs use order books to match buyers and sellers, ensuring smooth transactions. But here’s the catch – unlike their decentralized cousins, CEXs are governed by a single entity and usually come with custodial wallets.

But why are CEXs such a big deal, and what makes them tick? Let’s dive in and find out!

What’s a Centralized Cryptocurrency Exchange (CEX)?

Picture this: you’re at a bustling market, surrounded by traders buying and selling goods. That’s kind of what a CEX is like – a digital marketplace where users can trade cryptocurrencies with ease.

CEXs are owned and operated by a single entity, acting as the middleman between buyers and sellers. They use order books to match trades and provide liquidity for various tokens.

One of the defining features of CEXs is their custodial wallets. When you use a CEX, you’re essentially entrusting them with your funds, which they hold in custodial accounts. This centralized control allows for faster decision-making and efficient services.

But wait, there’s more! CEXs also require you to undergo KYC verification, ensuring compliance with local regulations and keeping your funds safe and secure.

How Do Centralized Exchanges Work?

Imagine you’re at a busy marketplace, shouting out your orders to buy or sell goods. That’s kind of how a CEX operates – users place buy or sell orders on the platform, and the exchange matches these orders to execute trades.

CEXs use order books to keep track of all the buy and sell orders, ensuring fair and transparent trading. When a buy order matches a sell order, the exchange facilitates the trade and charges a fee for its services.

But what sets CEXs apart from their decentralized counterparts? Let’s take a closer look!

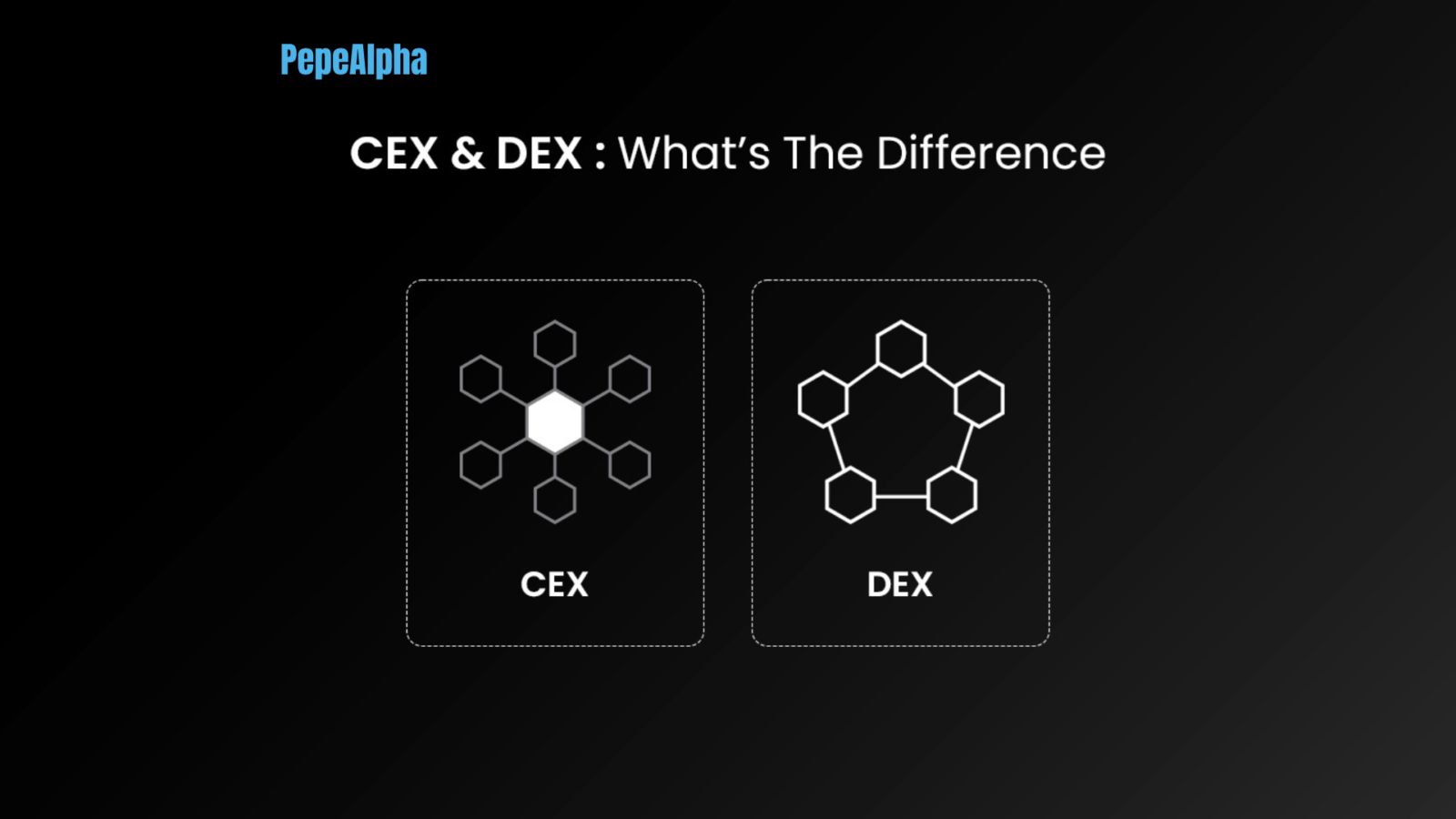

Centralized Vs. Decentralized Exchanges (CEX VS DEX): What’s The Difference?

CEXs and DEXs are like two sides of the same crypto coin – each with its own unique features and benefits.

CEXs are governed by a single entity, offering streamlined services and advanced trading tools. However, they come with risks like centralization and custodial control.

On the other hand, DEXs are decentralized platforms that allow users to trade directly with each other, without the need for a middleman. They offer greater privacy and control over your funds but may lack some of the features found on CEXs.

Examples of Centralized Exchanges:

From the bustling Binance to the trusted Kraken, there are plenty of CEXs to choose from in the crypto world. Some of the most popular ones include:

- Binance: The largest CEX in the world, offering a wide range of cryptocurrencies and trading pairs.

- Coinbase: A user-friendly CEX based in the US, known for its ease of use but higher fees.

- Kraken: A trusted exchange with low fees and a variety of trading options.

Do I Need To Use a Centralized Exchange?

If you’re looking to buy crypto using fiat currency or want access to advanced trading features, then yes, a CEX might be your best bet. However, it’s essential to weigh the benefits and risks before diving in.

Using a Centralized Exchange Securely:

If you choose to use a CEX, it’s essential to prioritize security and protect your assets. One way to do this is by using a hardware wallet like Ledger, which allows you to buy crypto directly from a CEX without forfeiting ownership of your private keys.

So there you have it, folks – a crash course on Centralized Exchanges, brought to you by your favorite crypto frog, Pepe! Remember to trade responsibly and keep those assets safe and secure. Until next time, happy hopping! 🐸✨

Leave a Reply