— When you hop into the crypto world, watch out for slippage! It might make you pay more than you planned.

— Slippage varies in the crypto jungle, so calculate wisely to make sure you’re not caught off guard.

— Don’t fret, though! There are ways to dodge slippage traps and keep your crypto journey smooth and profitable.

Ribbit, ribbit! If you’ve ever taken a leap into the world of cryptocurrencies, you might have encountered a slippery little fellow called slippage. It’s like trying to catch a fly and ending up with a mouthful of water instead. But fear not, dear crypto explorer, for Pepe is here to guide you through these murky waters.

What is Slippage in Crypto?

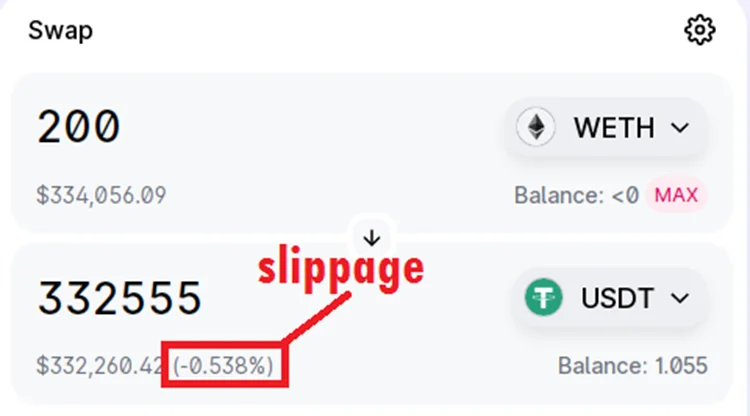

Picture this: You’re ready to make a trade, but when you hit that button, the price you end up paying isn’t what you expected. That difference between what you planned to pay and what you actually pay is what we call slippage. It’s like thinking you’re getting a juicy fly, but it turns out to be a tadpole instead.

Why Does Slippage Happen?

Ah, the mysteries of the crypto jungle! Slippage is caused by market conditions, but let’s dive deeper, shall we?

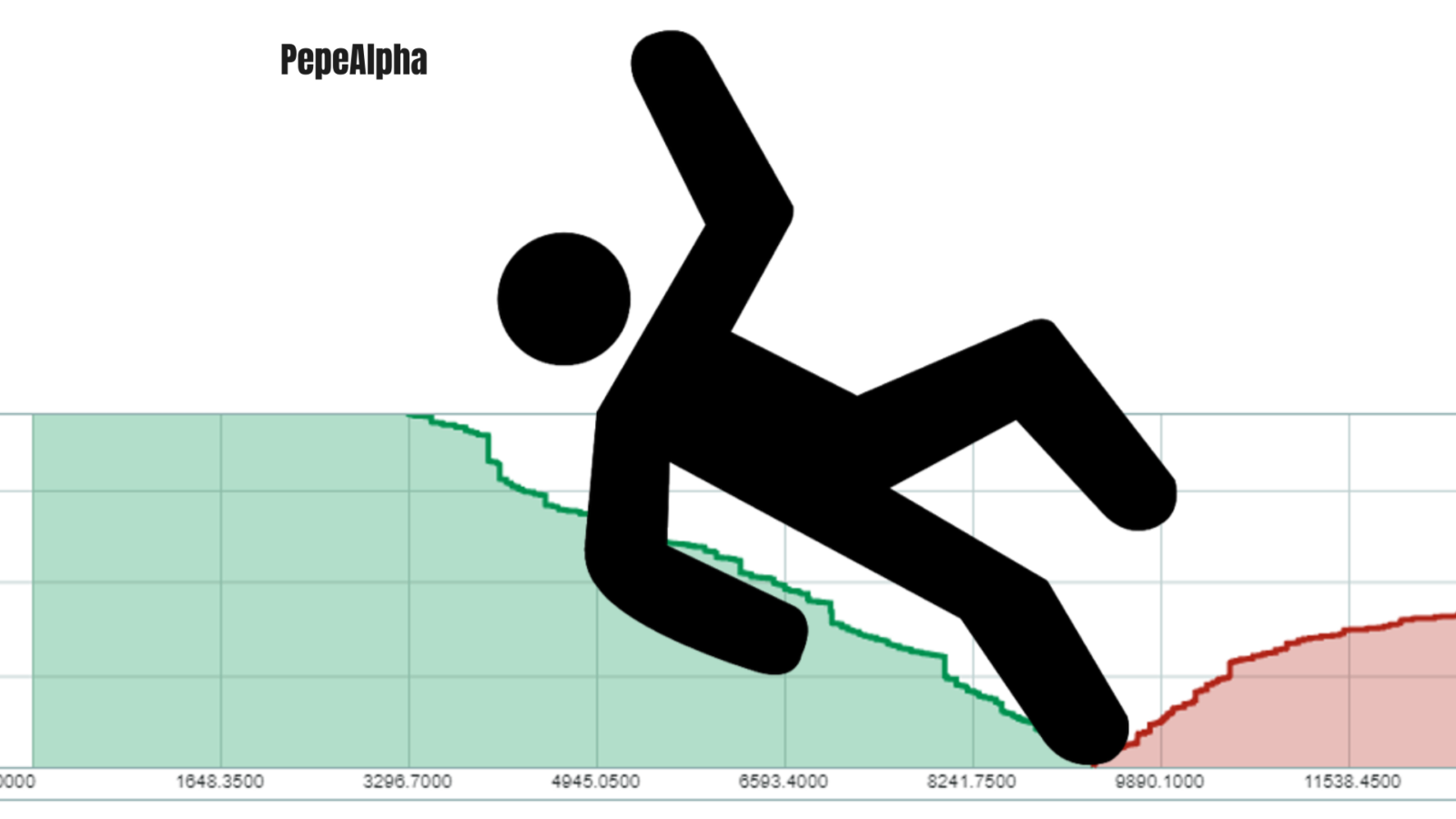

- Volatility: The crypto market is like a wild jungle party, with prices swinging up and down like monkeys in the trees. This volatility can mess with your trades, making you pay more than you bargained for.

- Low Market Liquidity: Imagine trying to buy cupcakes at a market, but there aren’t enough to go around. You end up paying more than you planned because you have to hop from stall to stall. That’s what happens in the crypto world when there’s not enough liquidity.

- Network Congestion: Just like a busy road, blockchains can get clogged up with transactions. If everyone’s trying to cross the bridge at once, your trade might get stuck in traffic, causing slippage.

How to Calculate Crypto Slippage:

Now that you know what slippage is and why it happens, let’s talk numbers. To calculate slippage, you need to find the difference between the price you expected to pay and the price you actually paid. It’s like counting how many tadpoles you caught instead of flies.

How to Avoid Crypto Slippage:

Nobody likes surprises, especially not Pepe! Here are some tips to avoid slippage and keep your crypto journey smooth:

- Limit Orders: Set a price you’re willing to pay and stick to it, just like catching flies with a net instead of your tongue.

- Stop Losses: Put a leash on your trades and don’t let them run wild. Set a limit to how much you’re willing to lose, and stick to it.

- Trading Bots: Let the bots do the work for you! They’re like trusty sidekicks, helping you navigate the jungle and avoid slippage traps.

- Analyze the Market: Keep an eye on market conditions and adjust your trades accordingly. Knowledge is power, after all!

Slippage Across Different Blockchains and Platforms:

Not all swamps are created equal, and the same goes for crypto exchanges. Each one has its own quirks and pitfalls, so do your research before you take the plunge. Whether you’re trading on a centralized exchange or a decentralized one, watch out for slippage lurking in the shadows.

Slippage is Just One Aspect of Crypto Trading:

So there you have it, fellow crypto adventurers! Slippage might be a slippery foe, but with Pepe’s guidance, you can navigate the waters of the crypto jungle with ease. Just remember to stay vigilant, keep your wits about you, and never stop exploring. Happy trading, ribbit! 🐸

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.