So, picture this: Polymarket—a blockchain-powered, no-nonsense prediction platform—pulls in a staggering $3.5 billion in trading volume during the U.S. election. The stakes were high, and some users made serious bank. But alas, it seems they’ve caught the eye of France’s top gambling authority, and ooh là là, they’re not thrilled.

According to French media source The Big Whale, the National Gaming Authority (ANJ) is seriously considering a ban on the platform. The question? Whether Polymarket’s bold, blockchain-based bets jive with French gambling laws. Spoiler: It’s looking dicey.

The High Roller: “Theo” Bets Big on Trump

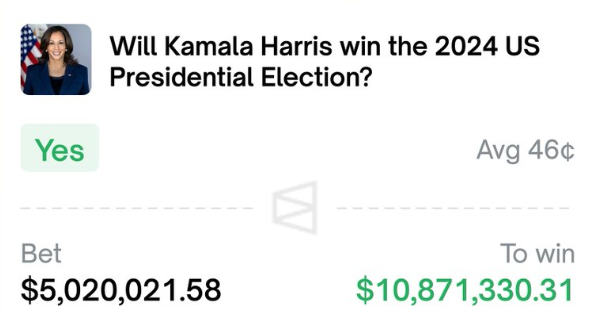

Now, here’s where it gets juicy. Enter Theo—a French trader with a serious taste for political risk. When everyone else was debating polls and headlines, Theo was stacking up multi-million-dollar bets on Trump’s victory. And guess what? The former president’s win raked Theo in a cool $47 million.

But as Theo’s earnings soared, so did suspicions of market manipulation. People started wondering, “Who’s this guy making these monster bets?” The Wall Street Journal tracked him down, and Theo admitted he’d poured over $30 million into betting on Trump’s win, chalking it up to his “personal political views.” Sound legit? Well, French regulators seem to think differently.

Polymarket vs. France: A Potential Ban on the Horizon

ANJ, France’s strict gambling overseer, has some serious muscle when it comes to blocking platforms. They can not only restrict domains but even warn media outlets against linking to Polymarket. A bit intense, right? If France greenlights this move, Polymarket might face major roadblocks, but it’s not game over. Tech-savvy users could still sneak in through VPNs, with no ID required—just a crypto wallet and a finger ready to click “bet.”

The timeline for ANJ’s decision isn’t clear yet, but Polymarket’s not out of hot water. This platform, loved for its decentralized, bet-on-anything ethos, is also under investigation by the U.S. Commodity Futures Trading Commission (CFTC). Back in 2021, the CFTC proposed some rules to tighten control over prediction markets, fearing manipulation risks. Yet here Polymarket stands—$74 million raised from big-name investors like Vitalik Buterin. Despite regulatory headwinds, the allure of crypto predictions is very much alive.

Election Day Frenzy: Polymarket’s Record-Breaking Numbers

As America headed to the polls in 2024, Polymarket saw a tidal wave of activity. Election Day alone saw a staggering $294 million in trading volume, with bets pouring in on either side of the Trump vs. Biden face-off. By close of day, open interest (the total value of all bets) hit a jaw-dropping $463 million, up 40% in just a week.

And here’s the thing: Polymarket isn’t your grandma’s betting site. Built on blockchain, it lets users bet in crypto without the middlemen. That means lower fees, faster transactions, and, most importantly, no need to hand over your ID. It’s all about privacy and autonomy—features that appeal to a new generation of bettors.

Regulatory Woes: The Global Scrutiny of Prediction Markets

Polymarket’s not the only player facing heat. Around the world, prediction markets have been struggling to operate freely, especially in regions where gambling laws weren’t exactly built for the blockchain age. Regulators worry about potential for insider trading and manipulation, and in the eyes of some, prediction platforms blur the lines between entertainment and exploitation. Polymarket’s initial U.S. election market saw massive volume and open interest, bringing a mix of scrutiny and admiration.

But despite the skeptics, prediction markets like Polymarket keep attracting billions in bets. Why? Because it’s not just about “I bet he’ll win.” These markets, decentralized as they are, give people a way to express political and economic opinions—and make a little crypto while they’re at it. Sure, there’s some controversy, but Polymarket’s even gained a reputation for predicting events before they hit mainstream headlines. Rumor has it the platform accurately signaled both Biden’s withdrawal and Trump’s win before they were widely anticipated. Talk about clairvoyance!

What’s Next? Polymarket’s Path Forward

With regulation looming, Polymarket has some choices. Will it adapt and tighten up? Decentralize further? Launch a governance token so users call the shots? Only time will tell. A decentralized governance model could give the community a stake in decision-making, potentially dodging regulatory woes while keeping that crypto-anonymous charm.

And despite ANJ’s impending judgment, it’s clear Polymarket’s not just about betting; it’s about tapping into the “wisdom of the crowd” and creating markets around information, not just cash. Will the French regulator play spoiler to the betting revolution, or will Polymarket find a way to keep its dice rolling?

As they say in Paris, la suspense est insoutenable.

Links:

https://polymarket.com/

https://twitter.com/Polymarket

https://discord.gg/Polymarket

Leave a Reply