Welcome, fellow crypto enthusiasts, to a journey through the fascinating world of on-ramping and off-ramping in the crypto universe! In this adventure, we’ll delve into the processes of entering and exiting the crypto market, uncovering the intricacies of on-ramping (buying crypto) and off-ramping (selling crypto), and exploring the various methods and platforms available for navigating this dynamic landscape. So let’s buckle up and embark on this exhilarating ride!

Understanding On-Ramping and Off-Ramping

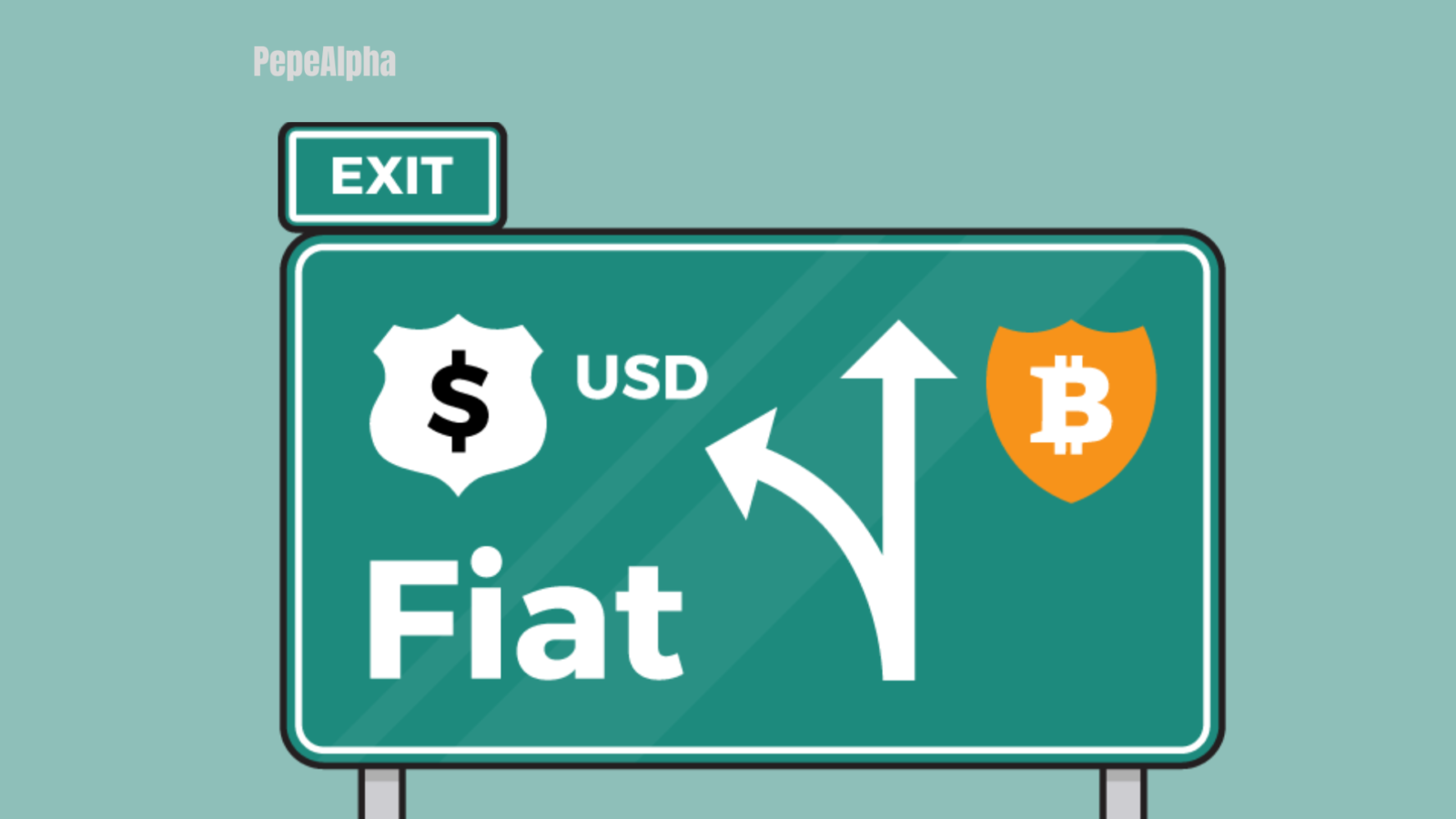

Before we dive into the details, let’s clarify what we mean by on-ramping and off-ramping in the context of the crypto universe. On-ramping refers to the process of acquiring cryptocurrencies, typically through the exchange of fiat currency (e.g., USD, EUR) for digital assets (e.g., Bitcoin, Ethereum). This can be done through various channels, such as crypto exchanges, peer-to-peer platforms, or cryptocurrency ATMs.

On the other hand, off-ramping involves converting cryptocurrencies back into fiat currency or other assets. This process allows crypto holders to realize their gains, make purchases in traditional markets, or simply cash out their investments. Off-ramping can also take place through exchanges, peer-to-peer platforms, or cryptocurrency debit cards.

Methods of On-Ramping and Off-Ramping

Now that we have a clearer understanding of the concepts, let’s explore the different methods available for on-ramping and off-ramping in the crypto universe:

- Cryptocurrency Exchanges: Cryptocurrency exchanges are one of the most common and convenient ways to on-ramp and off-ramp in the crypto market. These platforms allow users to buy and sell a wide range of cryptocurrencies using fiat currency or other digital assets. Popular exchanges include Coinbase, Binance, Kraken, and Gemini.

- Peer-to-Peer Platforms: Peer-to-peer (P2P) platforms connect buyers and sellers directly, allowing them to trade cryptocurrencies without the need for intermediaries. Platforms like LocalBitcoins and Paxful facilitate P2P transactions, enabling users to buy and sell crypto using various payment methods, including bank transfers, cash, and online payment systems.

- Cryptocurrency ATMs: Cryptocurrency ATMs, or Bitcoin ATMs, are physical kiosks that allow users to buy and sell cryptocurrencies using cash or credit/debit cards. These machines provide a convenient way for individuals to on-ramp and off-ramp in the crypto market, particularly in regions with limited access to traditional banking services.

- Cryptocurrency Wallets: Some cryptocurrency wallets offer built-in features for on-ramping and off-ramping, allowing users to purchase and sell cryptocurrencies directly within the wallet interface. Examples include the Blockchain.com Wallet and the Trust Wallet, which offer integrated exchange services powered by third-party providers.

Considerations and Challenges

While on-ramping and off-ramping provide access to the crypto market, they also come with certain considerations and challenges. These include:

- Regulatory Compliance: On-ramping and off-ramping may be subject to regulatory requirements and KYC (Know Your Customer) procedures, depending on the jurisdiction and the platform used. Users should ensure compliance with relevant regulations and be prepared to provide identification and other verification documents when necessary.

- Security Risks: Cryptocurrency transactions involve the transfer of digital assets, which can be susceptible to hacking, fraud, and other security risks. Users should exercise caution when using online platforms and take steps to secure their accounts and private keys.

- Transaction Fees: Many on-ramping and off-ramping methods incur transaction fees, which can vary depending on the platform, payment method, and transaction size. Users should consider these fees when evaluating the cost-effectiveness of different options.

Conclusion

In conclusion, on-ramping and off-ramping are essential processes in the crypto universe, allowing individuals to enter and exit the market and participate in the burgeoning world of digital assets. Whether through exchanges, peer-to-peer platforms, ATMs, or wallets, there are various methods available for buying and selling cryptocurrencies, each with its own benefits and considerations. By understanding these processes and exploring the available options, crypto enthusiasts can navigate the crypto universe with confidence and seize the opportunities it presents. So keep exploring, keep learning, and embrace the transformative power of crypto in your journey through the digital frontier! 🚀✨

Leave a Reply